The Financial Accounting Standards Board (FASB) issued updates to its 2016 Accounting Standards Codification (ASC) Topic 842, Leases—the standard that changes how organizations following US generally accepted accounting principles (GAAP) account for and disclose leases.

The Financial Accounting Standards Board (FASB) issued updates to its 2016 Accounting Standards Codification (ASC) Topic 842, Leases—the standard that changes how organizations following US generally accepted accounting principles (GAAP) account for and disclose leases.

The new updates, Accounting Standards Updates (ASU) 2018-10 and 2018-11, clarify portions of the original standard and streamlines the application process. These updates will offer simpler adoption options for many restaurants. Here are the important updates each ASU provides:

- ASU 2018-10. This update affects lessee reassessment of lease classification and variable lease payments that depend on an index or a rate, among other things.

- ASU 2018-11. This update introduces a new transition option that may bring relief to comparative reporting requirements on initial adoption.

While the new ASUs may make adoption easier, applying the standards correctly still requires time and preparation.

Background

Upon original issue, ASC Topic 842 specified the new leasing standard must be adopted and applied on a modified retrospective basis, starting with the earliest period presented in a company’s financial statements.

This meant restaurant owners needed to begin accumulating information to adopt the new standard long before the effective date so that, in the case of public companies, information for 2017 and 2018 would be readily available when they prepared their 2019 financial statements. This resulted in a challenging application process for many companies.

Changes for Restaurants

While application requirements for ASC Topic 842 are staying the same, the new transition option changes the timing for applying the standard. The new ASUs are designed to make implementation easier and reduce costs for financial statement preparers. As a result, lessees can now apply the transition provisions in the period of adoption rather than in the earliest comparative period in their financial statements.

To learn more about the original standard, take a look at our article on ASC Topic 842, Leases.

Implement the Standard

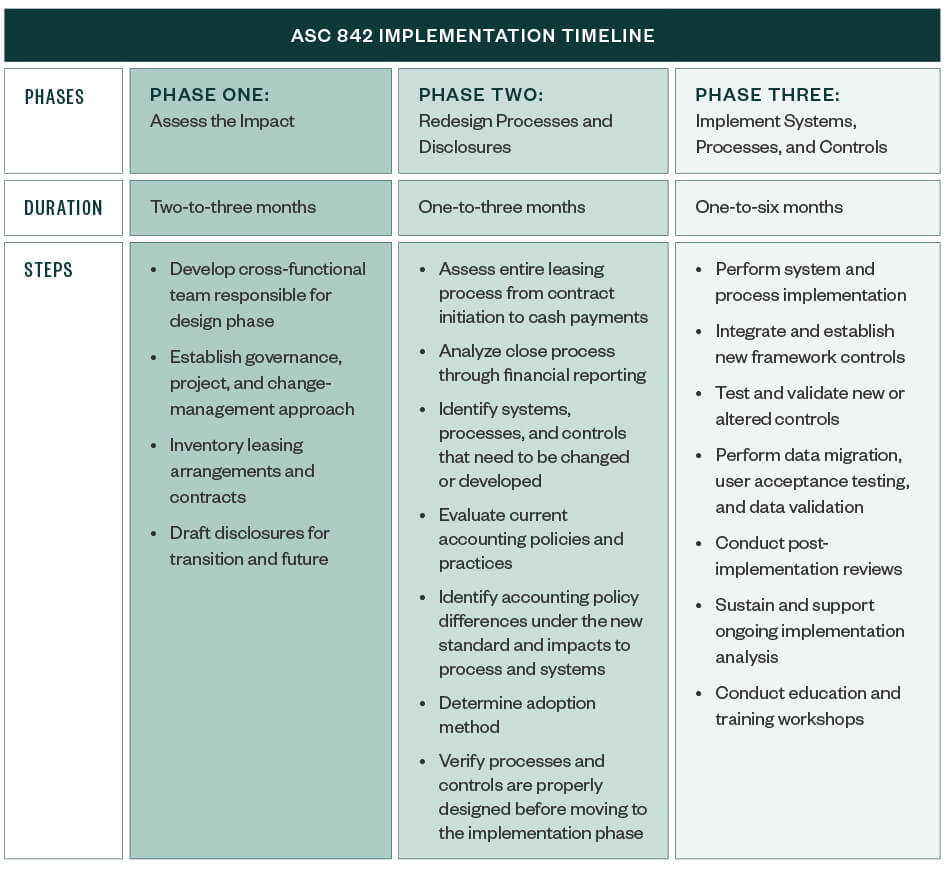

While it may seem like there’s plenty of time to apply the new standard, correct implementation may take restaurant owners anywhere from four-to-twelve months, depending on the complexity of the company and the resources available. Waiting too long to adopt the new standard could result in disruption for you and your stakeholders.

To benefit fully from the changes, restaurants can apply the following three-phase model:

Adoption Challenges

The restaurant industry relies heavily on leases. As a result, there may be many items a restaurant owner needs to account for on financial statements—from physical space to soda fountains and kitchen equipment. Because the new standard updates the definition of a lease in GAAP, there may be items a restaurant needs to account for without knowing it.

Further, many leases are embedded within contracts. Restaurant owners often don’t realize they need to search for these embedded leases, and the decentralized nature of lessee agreements can result in the process taking a great deal of time and effort during adoption.

Application Strategies

To avoid potential setbacks and pitfalls, restaurant owners with many leases can benefit from adopting the standard early and investing in a new IT solution.

Regardless of your company’s size or structure, having the correct technology in place can help automate leasing calculations and reduce errors. This can save time, resources, and money throughout the application process and allow your accounting department to support accelerated company growth when new locations are being negotiated or opened.

To determine which IT solution meets your company’s needs, consult a finance or IT professional or request multiple demos from IT companies. You can then try each solution and determine which platform provides the most benefits.

Benefits of an IT Solution

Here are a few benefits an integrated IT solution can provide based on specific company criteria.

- Global company. A global company can have thousands of locations, making it difficult to apply the same standards across different exchange rates, languages, and locations if your methods aren’t automated. An IT solution can integrate your company’s data and controls, reducing time and resources spent on inefficient consolidations and workarounds.

- Domestic company with many locations. An effective IT solution consolidates business processes in all locations, centralizing efforts and reducing the threat of human error.

Effective Dates

The new ASUs are effective at the same time as the new leases standard, which is effective for public business entities in fiscal years beginning after December 15, 2018. This includes interim periods within those years. The standard is effective for private entities in fiscal years beginning after December 15, 2019, and interim periods beginning after December 15, 2020.

ASC Topic 842 may be adopted early. To stay proactive, private companies should begin adopting the updates before the end of the first quarter of the fiscal year.

We’re Here to Help

For more information about how these changes could affect you or your company, contact your Moss Adams professional.